Recent Blog

"Mastering Debt Funds: Strategic Approaches for Smart Investing"

Investing in debt mutual funds offers a balance between returns and safety, but it's crucial to understand the strategies involved, especially focusing on accrual and duration approaches.

Accrual funds, including overnight, liquid, ultra-short duration, low duration, and income funds, primarily generate returns through interest income by holding debt instruments until maturity. These funds prioritize stability and consistent income, making them suitable for investors seeking steady returns with minimal interest rate volatility.

On the other hand, duration funds, including medium duration, medium to long duration, long duration, gilt, and 10-year constant maturity gits, capitalize on changes in interest rates to generate capital appreciation. During periods of decreasing interest rates, longer-duration funds tend to yield higher returns, while in times of increasing rates, shorter-duration funds are favored.

Currently, there's speculation of a potential reduction in interest rates by the Reserve Bank of India, which could enhance returns in longer-duration debt funds. However, timing is critical, and investors must carefully assess their risk appetite and tolerance for volatility. Timely entry and exit from longer-duration funds are essential to maximize returns and mitigate risks associated with interest rate fluctuations.

For instance, imagine an investor having a 10-year government bond with a 7.5% coupon rate at its face value. If interest rates rise, newer bonds with higher coupon rates may be issued, decreasing demand for existing bonds with lower coupon rates. This could result in a mark-to-market loss if sold. Conversely, declining interest rates may increase demand for higher-yielding existing bonds, leading to potential capital gains upon sale.

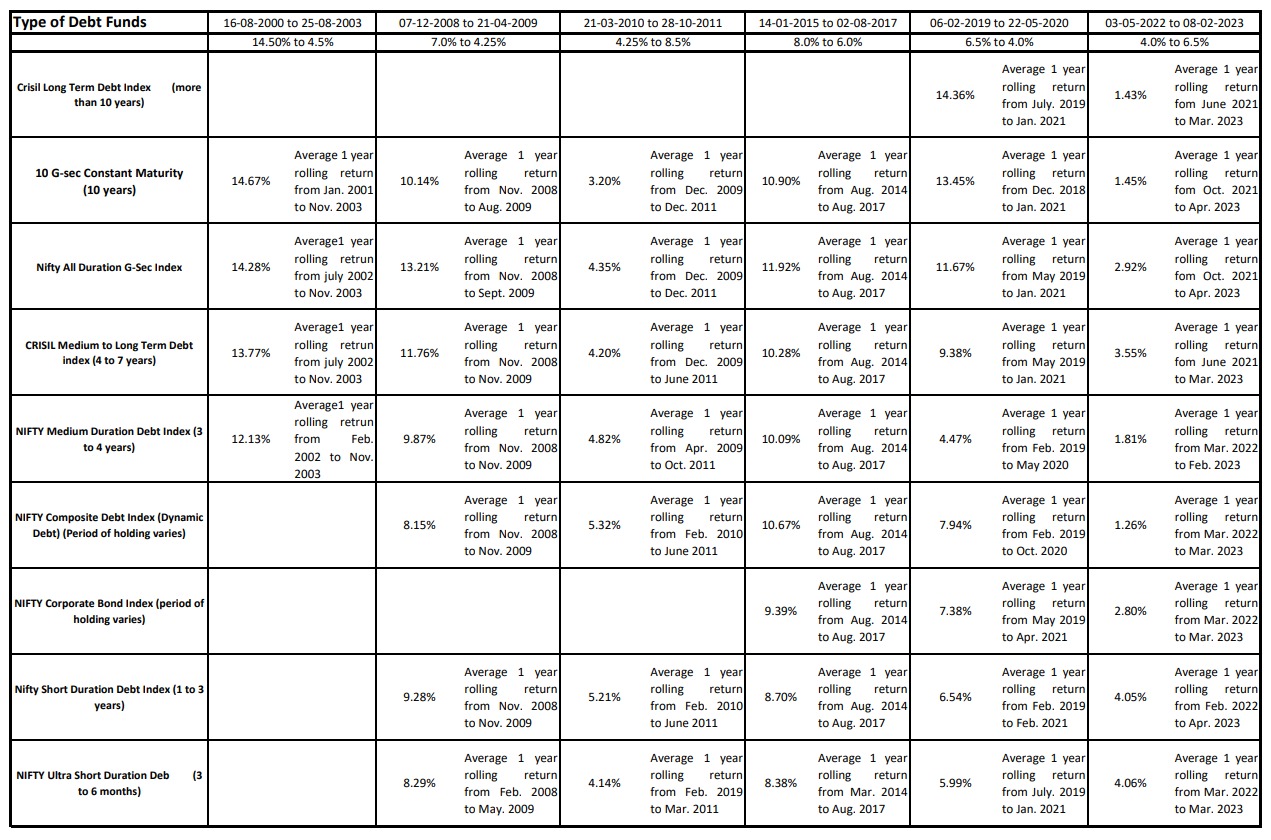

A comparative table has been devised to analyze the returns across various categories of debt funds based on the duration of their debt instrument holdings, focusing on periods where interest rates experience significant shifts of 2% or more.

During periods of decreasing interest rates, longer-duration debt instruments have tended to generate higher returns. Conversely, in times of increasing interest rates, longer-duration debt instruments have yielded lower returns.

In summary, understanding the differences between accrual and duration strategies is crucial for investors. Accrual funds offer stability and consistent income, while duration funds provide opportunities for capital appreciation by actively managing interest rate risk. Investors should align their investment objectives and risk tolerance with the appropriate strategy to build a resilient portfolio.