Recent Blog

Who Should Not Invest in Equity Mutual Funds

Investing in equity mutual funds or equities can be an excellent way to build wealth over the long term. However, these investments are not suitable for everyone. Below are detailed points explaining who should avoid investing in equity mutual funds, along with the reasoning behind each point:

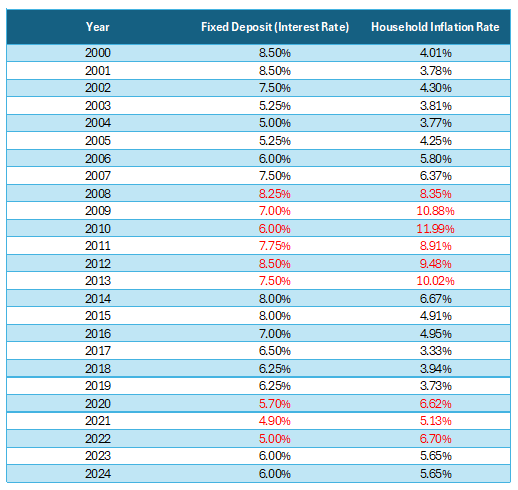

1. People Who Do Not Prioritize Beating Inflation If you are not concerned about increasing your wealth to outpace inflation, equity mutual funds may not be for you. Over the last 20 years, the average inflation in India has been approximately 6.50%. However, this figure includes outdated items like radios, tape recorders, CDs, fax machines, type writers, etc., which skew the accuracy of inflation data. The real inflation that impacts common people is much higher. For example:

- • Food prices: Increased by an average of 6.20% annually.

- • Education costs: Rose by 8-10% annually.

- • Medical expenses: Escalated by 10-15% annually.

- • Clothing: Grew by 6.2% annually.

Fixed deposit (FD) returns during the same period have failed to beat this practical inflation. For instance, ₹1 lakh in a fixed deposit would erode to about ₹90,000 in 5 years or even ₹82,000 in 10 years after adjusting for inflation. If you are content with this erosion of your purchasing power, equity mutual funds are not for you.

2. People Without Clear Financial Goals Investing without goals is like driving without a destination. Equity mutual funds are best suited for disciplined investors with clear objectives, such as:

- • Buying a house

- • Funding education

- • Planning for retirement and so on

Having goals helps differentiate between needs and wants, instils financial discipline, and ensures proper allocation of resources. If you invest aimlessly, you may lack the motivation to stay invested during market downturns. Without goals, it’s easy to make impulsive or emotional decisions.

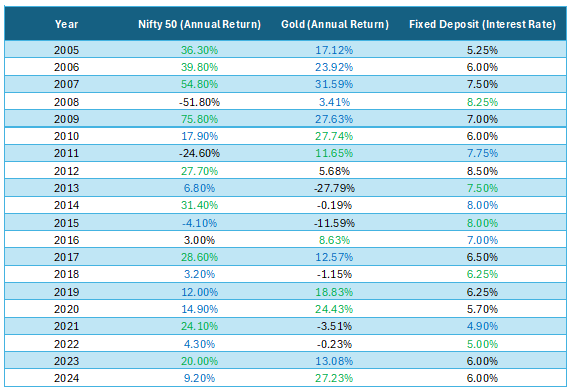

3. People Who Don’t Believe in Asset Allocation Asset allocation is crucial for a stable and consistent portfolio. Equity mutual funds alone cannot guarantee the highest returns all the time.

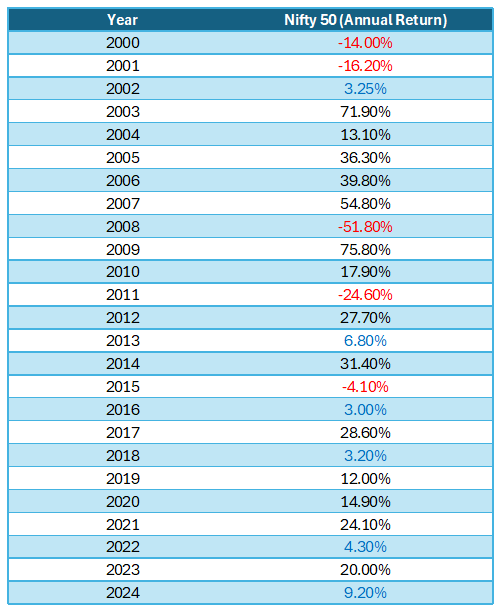

- • Over the last 25 years, the Nifty 50 has delivered negative returns 5 times and sub-5% returns 5 times.

- • Gold outperformed the Nifty 50 in 6 instances, while fixed deposits outperformed equities in 5 instances.

A balanced mix of equities, debt, and gold can stabilize your portfolio, reduce risk, and provide consistent returns. If you don’t believe in diversifying your investments, equity mutual funds alone may not fulfil your expectations.

4. People Who Consider Market Volatility as Permanent Loss Equity markets are inherently volatile. If you believe that market fluctuations result in permanent loss, you should avoid equity mutual funds. Permanent loss only occurs when you sell your investments during a downturn.

- • Over the last 25 years, the Nifty 50 has delivered negative returns in 5 years and sub-10% returns in 6 years.

- • Despite this volatility, the Nifty 50 achieved an average CAGR of approximately 11.3%.

Volatility is temporary, but long-term investors are rewarded. If you cannot tolerate market ups and downs, equity mutual funds may not align with your expectations.

5. People Who Think Distributors Control Returns Mutual funds may not be the right investment for you if you believe that distributors or advisors are responsible for generating returns. Returns come from the market’s performance, not the distributor. Their role is to guide you in making informed decisions, align your investments with your financial goals, and help manage risk. Unrealistic expectations about distributors can lead to disappointment, especially during market downturns. Similarly, choosing direct plans without proper knowledge can result in poor decisions and financial strain during emergencies if you:

- • Ignore your financial goals or risk tolerance

- • Lack adequate liquidity for emergencies

- • Focus only on past returns instead of suitability

If you misunderstand the role of distributors or overlook market dynamics, you may face financial trouble and blame the wrong factors. To make the most of mutual funds, work with advisors who educate you, manage your expectations, and help you stay disciplined during market fluctuations. Success in mutual fund investing requires clear goals, proper guidance, and a focus on long-term growth.

6. People Relying on Advice from Social Media or Friends If you make investment decisions based solely on TV recommendations or advice from friends, you are setting yourself up for disappointment. Such sources often sensationalize past returns and extrapolate them into the future, creating unrealistic expectations. A fund that delivered 50% returns last year might only yield 5% due to market corrections. Investing based on such advice often leads to disappointment. Instead, focus on personalized strategies that match your risk tolerance and goals.

7. People Investing Because Friends Are Investing Everyone has unique financial goals, risk tolerance, and income levels. Blindly following friends’ investment choices can lead to poor outcomes. For instance:

- • There are over 290 open-ended equity mutual fund schemes in India, of which about 60% beat their benchmarks. You cannot invest in each and every scheme. Chances of different schemes in portfolios between yours and him are high.

- • Your friend’s investment might suit their goals but not yours.

Investing without understanding your own requirements will likely lead to dissatisfaction.

8. People Expecting Quick or Consistent High Returns If you believe equity mutual funds can consistently deliver 20-25% or more annual returns, you are likely to be disappointed. Equity markets have periods of underperformance:

- • In the last 25 years, the Nifty 50 delivered negative returns 5 times and sub-5% returns 5 times.

- • Yet, the long-term CAGR remained at 11.3%.

Equity mutual funds require patience and a long-term outlook. They do not offer linear or guaranteed returns. If you are looking for quick gains, equity mutual funds are not the right choice.

9. People Who Invest Solely Based on Past High Returns Chasing top-performing funds is a flawed strategy. If you invest solely in top-performing funds based on their past returns, research consistently shows that such a strategy often leads to underperformance compared to staying invested in diversified or well-balanced funds. Studies by Morningstar, S&P Dow Jones Indices, and CRISIL have highlighted the following findings about chasing top-performing funds:

- Average Future Returns Drop:

Funds that performed exceptionally well in one year often fail to sustain their performance. The average future returns of last year’s top funds typically fall to 7–10% annually, significantly lower than market averages.

- Consistency is Rare:

- Only 10–15% of top-performing funds stay in the top quartile for consecutive years.

- Funds ranked in the top 25% often fall to the bottom 50% or lower due to sector rotations, market corrections, or style changes.

Investing based solely on rankings increases the risk of underperformance. By relying on these studies, it becomes evident that chasing top-performing funds based on past returns is not a sound long-term investment strategy.

10. People Nearing Goals or Retirement Equities are risky for short-term goals. For example:

- • A person close to retirement aiming for ₹50 lakh might face a sudden market correction, reducing their portfolio to ₹40 lakh. This volatility can derail short-term plans.

- • Suppose you plan to fund your child’s college education or marriage in two years. You invest heavily in equities, expecting growth. However, a market downturn reduces your portfolio by 20%, leaving you short of your goal.

Shifting to safer investments like debt funds or FDs as you near your goals can mitigate this risk. Equity mutual funds are not ideal for short-term investments or for those nearing financial goals or retirement. The volatile nature of equities could impact your principal during market downturns. Equity investments require time to deliver expected returns. As you approach your goals, it’s better to shift to safer options like debt funds or fixed deposits.

Equity mutual funds are a powerful tool for wealth creation, but they require patience, discipline, and a long-term perspective. If any of the points above resonate with you, it might be better to explore other investment options or consult a financial advisor to determine the best strategy for your needs.